You’re Retired - Start Acting Like It

With the purchase of our home in Napa, plus some additional re-evaluation of our future finances, Julie and I have done a deep dive into our processes for managing our money at this stage of life.

Obligatory elderly couple doing retirement things

Obligatory elderly couple doing retirement things

Honestly, it has even moved us to reflect on the answer to this question: are we retired? Julie always answers “no”, I usually answer “sorta”. The answer is complicated for many of us in the FIRE movement: what if you keep working after you’ve achieved financial independence? I don’t think that really matters. Here’s what I think does: whether you are in the asset building phase, or asset depletion phase. And we are definitely in the asset depletion phase.

This doesn’t mean our net worth has been going down. Thanks to an everlasting bull market that I’m sure will never go away, our portfolio continues to grow faster than we can spend it. I periodically head over to Fidelity and move money into our checking account as I’m doing our monthly budgeting. Sometimes it might be $2k, sometimes it might be $15k. I track all of this in my financial management spreadsheet, and at the end of the year I take a look to see what our withdrawal rate is. About 8 years ago Julie and I agreed that somewhere in the 3.5% range should be a safe withdrawal rate for us.

But things are changing for us: we have a house in Napa with a mortgage that is a fraction of the value of the home, but still the largest mortgage we’ve ever had. Plus property taxes, insurance, utilities, and so on. All the homeowner stuff. So we have to budget for that now every month.

Meanwhile, I’ve been helping my sister plan for her imminent retirement (about 10 days away). Friend Jim has been a huge help in this process as we look at tax optimization for her. Her monthly cash flow needs seem too be well below the 4% threshold (to be more precise, 4% annually divided by 12 months) so we did not get too deep on exactly what would be a safe withdrawal number for her.

Coincidentally, I recently read Die With Zero and it raised a few important questions for me:

- Am I doing everything I can to help Julie be comfortable with our financial path?

- If we want to give more money away (or even spend more), how do we know what reasonable thresholds we should obey?

- What should be a reasonable goal for net worth when we both expire?

An interesting idea surfaced that could help give answers to all three of these: some form of deferred annuity that would survive the first spouse death (and hence guarantee further income for the other). I spent a week or so in annuity acronym soup: SPIA, DIA, QLAC, and even indexed annuities. There are a lot of folks out there that want to sell these products! And some of these products seem challenging to explain and sell.

I did some extensive modeling on these products and came to my own conclusion that, especially for a QLAC that currently has a $200k contribution limit, it would be almost a non-event for our financial forecast. Jim wisely suggested I up my modeling game and feed this into the safe withdrawal rate toolkit (SWR Toolkit). I had not visited this toolkit in many years and found that a combination of toolkit improvements and helpful videos made it well worth my time.

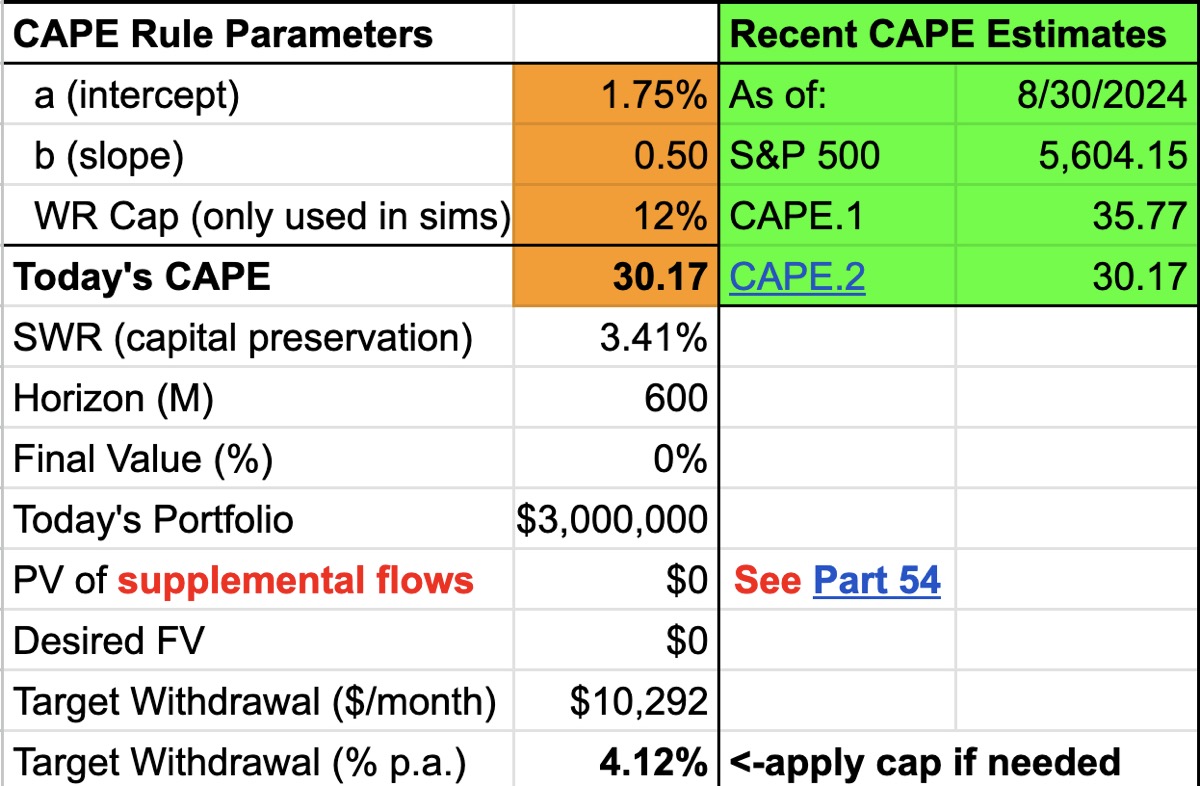

CAPE analysis in the SWR Toolkit with sample data

CAPE analysis in the SWR Toolkit with sample data

The helpful videos I speak of are the Safe Withdrawal Rate Series YouTube videos from Two Sides of FI. If you decide to dive into this model, watch the first video as you do your first set of data entry.

How did this help with my annuity evaluation? It has excellent cash flow modeling and allowed me to enter in a few different scenarios (when to start the deferred annuity, how long I think we will both live, when to start social security, etc.) and see updated feedback on failure rates: the likelihood that we will outlive our assets at different monthly withdrawal levels.

I spent most of my time looking at the CAPE-based Rule tab after putting my data in. Spend some time reading the article I linked to: this approach fits perfectly with our desire to dynamically adjust our withdrawal rate based on current asset portfolio and market conditions. Case in point:

All the historical failures of the 4% Rule have occurred when the CAPE earnings yield (= one divided by the Shiller CAPE Ratio) was under 5%, i.e., when the CAPE Ratio was above 20.

As of end of August 2024, the CAPE Ratio is about 30. Roughly speaking: P/E ratios are high, we might be on the edge of a bubble burst, so be prepared for some correction.

In just about every scenario, a small annuity made an improvement in portfolio failure rate. The “endless” cashflows help mitigate the risk living super long and seeing your portfolio deplete. This is the purpose of an annuity after all - buying insurance to hedge against a long lifetime (opposite of life insurance).

Lastly, I’ve been using the simple heuristics from The Retirement Manifesto to coach my sister on using a bucket strategy to build her retirement paycheck. This lead to the obvious question: why aren’t Julie and I doing this?

It is time to start. Here are my actions over the next few weeks:

- We likely will open a QLAC from my traditional IRA funds, maybe at the $200k level or possibly laddered starting at $100k.

- We will use our non-brokerage Fidelity money market checking account as a holding tank for our cash holdings, keeping that full of (for now) 18 months of cash withdrawals for our retirement paycheck.

- Be more diligent about managing our asset allocation, which for now will likely stay at about 75% equities, 18% bonds (income bucket), 7% cash equivalent.

- Turn on our retirement paycheck as a monthly withdrawal from the cash bucket. I’m rounding the CAPE-based Target Withdrawal ($/month) down to the nearest $1,000 and turning that on as an automatic transfer.

- Document a detailed quarterly process to review and adjust the paycheck and budgets based on the latest information.

We still use YNAB to budget and track our spending. With a fixed retirement income, and variable job income (I’m paid about 9 months out of the year for teaching, Julie works variable hours), we can budget the excess cash flow towards future purchases, gifts, or trips we want to take. This feels like a sounder approach for us.